Medical technology firm BIOTRONIK has agreed to divest its vascular intervention (VI) business to Teleflex for approximately €760m.

This deal is part of a major transformation at Teleflex. The company has also announced plans to split into two independent, publicly traded entities.

BIOTRONIK stated that its move is intended to strengthen its position in active implantable devices and digital healthcare. The company aims to focus on future technologies, including artificial intelligence (AI), remote patient monitoring, and connected healthcare platforms.

The vascular intervention business provides a portfolio of coronary and peripheral intervention solutions for catheterisation labs and interventional radiology suites.

Key products for coronary interventions include the Pantera Lux Drug-Coated Balloon Catheter, PK Papyrus Covered Coronary Stent, and Orsiro Mission Drug-Eluting Stent.

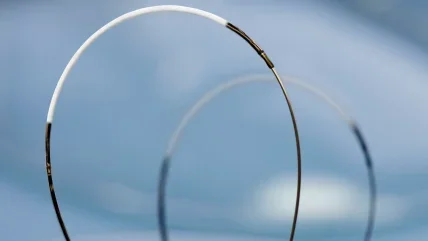

For peripheral interventions, the portfolio includes the Passeo-18 Lux Peripheral Drug-Coated Balloon Catheter, Dynetic-35 Balloon-Expandable Stent, and Pulsar-18 T3 Self-Expanding 4F Stent.

BIOTRONIK Group CEO Alexander Uhl said: “This strategic shift empowers us to amplify our investments in emerging technologies across Cardiac Rhythm Management, Patient Monitoring, Heart Failure, and Neuromodulation therapies.”

The acquisition of the vascular intervention business will provide Teleflex with an opportunity to invest in and expand clinical trials for BIOTRONIK’s Freesolve Resorbable Metallic Scaffold (RMS) technology.

Freesolve, which received CE Mark approval in February 2024, is indicated for the treatment of de novo coronary artery lesions.

The business to be acquired will expand the Teleflex interventional portfolio to include a wide range of vascular intervention devices.

In 2023, approximately 75% of revenue from the acquired business came from coronary interventions, while the remaining 25% was derived from peripheral interventional procedures.

Teleflex expects this acquisition to strengthen its offerings for cardiac and peripheral care specialists. The acquired products are projected to generate around €91m in revenue in Q4 2025.

The acquisition is subject to customary closing conditions and is expected to close by the end of Q3 2025.

In a separate development, Teleflex has unveiled plans to create NewCo, which will comprise its urology, acute care, and original equipment manufacturer (OEM) businesses.

Meanwhile, Teleflex RemainCo will retain its vascular access, interventional, and surgical businesses, primarily focusing on hospital-based emergency markets.

Teleflex chairman, president, and CEO Liam Kelly said: “The decision to pursue this separation was driven by our active portfolio management process and focus on driving shareholder value.”

The company expects the separation to be completed by mid-2026, subject to regulatory and customary approvals.