US-based healthcare technology company Merit Medical has executed an asset purchase agreement with EndoGastric Solutions to acquire the latter’s EsophyX Z+ device for $105m in cash.

EndoGastric Solutions designed the EsophyX Z+ device as a minimally invasive, non-pharmacological treatment for patients with gastroesophageal reflux disease (GERD).

GERD is a digestive disorder that occurs when the lower oesophageal sphincter fails to close properly, allowing digestive juices from the stomach to enter the oesophagus.

It may result in serious health conditions, such as oesophageal damage and cancer.

Merit Medical said the assets acquired from EndoGastric Solutions generated around $26m of revenue over the 12 months ended 31 December 2023.

The company expects the assets to generate $13m to $15m in revenue and dilute Merit’s previously forecasted non-GAAP operating margin, net income, and earnings per share.

Merit chairman and CEO Fred Lampropoulos said: “This acquisition is consistent with our Continued Growth Initiatives. It enhances our product portfolio in existing clinical specialities while expanding our global footprint in the multi-billion-dollar gastrointestinal market.

“We look forward to helping more patients by providing clinicians with a sustained and minimally invasive treatment option for chronic GERD.”

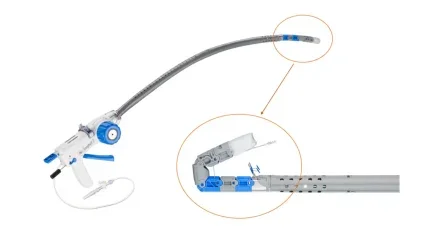

EsophyX Z+ device provides relief of GERD symptoms by restoring the body’s reflux barrier and reducing the acid reflux that causes long-term complications.

The treatment is performed under endoscopic visualisation during a minimally invasive procedure, dubbed Transoral Incisionless Fundoplication (TIF 2.0).

Recently, the American Gastroenterology Association released a clinical practice update on the evaluation and management of GERD and listed TIF 2.0 as an effective endoscopic option.

TIF 2.0 can also be combined with a surgical hiatal hernia repair, in a procedure known as concomitant transoral incisionless fundoplication (cTIF).

Oppenheimer & Co. served as a financial advisor and Parr Brown Gee & Loveless as a legal advisor to Merit, while Cooley served as legal advisor to EndoGastric, on the transaction.

Lampropoulos added: “In addition to the strong strategic rationale, we believe the financial profile of this acquisition is compelling.

“While modestly dilutive to our full-year 2024 non-GAAP profitability given the partial-year contribution, we expect the acquisition to be accretive to our non-GAAP gross and operating margins, non-GAAP net income and non-GAAP EPS in the first full year post-closing.

“Importantly, we reaffirmed our full-year 2024 financial guidance on a stand-alone basis and we look forward to discussing this acquisition and our updated outlook for 2024 on our second-quarter earnings report on 1 August 2024.”

Last month, Merit Medical and Medtronic expanded their partnership, to provide an unipedicular, steerable balloon catheter for vertebral compression fractures (VCF) in the US.